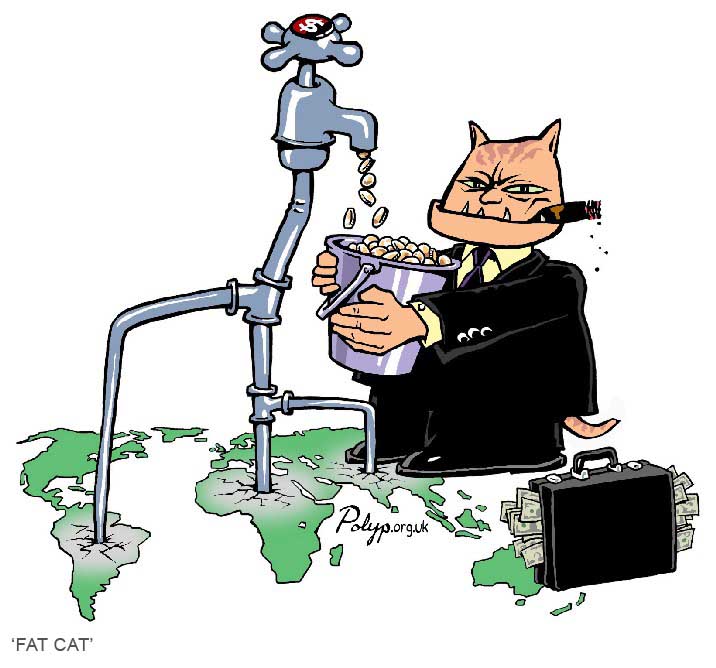

A small number of companies dominate private water provision and waste management around the world (see table below).

Until the 1980s most water supply and sewerage treatment around the world was provided by public authorities, apart from France where the two major transnational private companies are based.  However during the 1990s private water companies expanded into global markets by taking over public services. Most of that expansion however was in developing nations until 2002, where privatisation has been forced by the World Bank and IMF, and then in former communist nations of central and eastern Europe. The private water companies also made some inroad into the US where some 80 percent of water was being supplied by public authorities. They lobbied to get Congress to force municipal councils to privatise.

However during the 1990s private water companies expanded into global markets by taking over public services. Most of that expansion however was in developing nations until 2002, where privatisation has been forced by the World Bank and IMF, and then in former communist nations of central and eastern Europe. The private water companies also made some inroad into the US where some 80 percent of water was being supplied by public authorities. They lobbied to get Congress to force municipal councils to privatise.

the total number of private companies seeking to grow was very small, thus forming a de facto oligopoly, which often formed joint ventures with each other. This was reinforced by the fact that the existing companies were protected against new entrants by the length of their existing concessions, lasting 25 or 30 years and in some cases much longer... the companies’ growth in all continents was characterised by close relationships with development banks – especially the World Bank – donors and politicians.

By 2005 French companies Suez and Veolia and German company RWE controlled about 75 percent of the world’s private water supply market.

| Corporation | Country Base |

2009 Total Revenue |

2009 Water Revenue |

2009 Waste Revenue |

|---|---|---|---|---|

| Veolia Environnement | France |

€34.6 billion |

€12.56 billion |

€9 billion |

| Suez Environnement | France |

€12.3 billion |

€11.8 billion |

|

| Remondis | Germany |

€5.6 billion |

€5.6 billion |

|

| Waste Management, Inc | USA |

$13.4 billion (2008) |

-- |

$11.4 billion (2008) |

| Republic Services | USA |

$8 billion |

-- |

$8 billion |

At its height in 2002 Suez serviced 115 million people in 130 countries but in the last few years it has been withdrawing from developing countries. Today Suez Environnement employs almost 66,000 people, supplying 90 million people with drinking water, 58 million with watewater treatment in 70 countries, and 46 million people with garbage collection as well as 460,000 industrial and commercial clients. It operates hundreds of landfills and waste treatment facilities and thousands of water treatment plants.

At its height in 2002 Suez serviced 115 million people in 130 countries but in the last few years it has been withdrawing from developing countries. Today Suez Environnement employs almost 66,000 people, supplying 90 million people with drinking water, 58 million with watewater treatment in 70 countries, and 46 million people with garbage collection as well as 460,000 industrial and commercial clients. It operates hundreds of landfills and waste treatment facilities and thousands of water treatment plants.The major water companies often work together in joint ventures. For example Vivendi joined with RWE to run Berlin’s water system and Suez joined with RWE to run Budapest’s system. Suez also joined with RWE/Thames and the son of Indonesian dictator General Suharto to take over Jakarta’s water supply. And in France, there was a major judicial investigation into whether the three largest water companies, Suez, Vivendi and Bouygues, had formed an illegal cartel during the early 1990s.

Veolia and Suez were again accused in 2002 by the French competition council of anti-competitive behaviour; taking advantage of the 85 percent control they had of the French water market and collaborating in joint ventures (sometimes with a third company Saur) in a way that prevented competitive bidding for water contracts. Public Citizen claims that sometimes smaller companies like Saur and RWE/Thames had "to form a partnership with the two giants, Veolia and Suez, in order to establish themselves" in international markets. Examples include:

Waste Management, Inc (WMX) has been investigated several times by US Federal authorities for anti-trust activities. Anti-trust laws “prohibit a variety of practices that restrain trade, such as price-fixing conspiracies, corporate mergers likely to reduce the competitive vigor of particular markets, and predatory acts designed to achieve or maintain monopoly power.”

The large water companies jointly lobby governments and development banks through the International Federation of Private Water Operators, headquartered in Brussels. They also lobby for trade agreements through the European Services Forum and the UC Coalition of Service Industries (CSI).

Since 2002, the private water companies have been finding it difficult to make sufficient returns on their investment in the water sector in developing nations (see examples of failures), mainly because many households are unable to pay enough in rates to provide those returns and the development banks have discouraged government subsidies for water in developing nations even though they are widespread in Europe and the US. There has also been strong public opposition to water privatisation.

Suez announced its withdrawal from developing countries in 2003 unless its risks could be reduced through government guarantees. Thames Water withdrew from all its remaining water contracts in developing nations in 2006. In 2007 Saur announced with was withdrawing from Latin America as Suez already had.

Suez and Veolia maintain operations in Europe, North America, China, North Africa and the Middle East. However several of the larger transnational companies have divested themselves of their water operations, including Bechtel, Bouygues, E.on and RWE. The buyers of these water operations have tended to be private equity funds such as Macquarie Bank, and public sector bodies or state investment agencies such as the French state bank Caisse des dépôts et consignations (CDC).

The economic crisis also impacted on the large water transnationals. In 2009 Veolia prepared to sell €3 billion worth of assets and cut investment by 45% because of its large debt and Suez cut its planned investment by 25%. Also Suez and Veolia have separated their water and waste operations as Suez Environnement and Veolia Environnement and are part owned by CDC as is Saur (47%)