US schools traditionally get their funding from a combination of local property taxes, sales taxes, and income taxes. However during the 1970s and 80s there were a series of tax revolts that caused local property taxes – the major source of school funding – to be dramatically cut.

It all began in California. In 1971 and 1976 the Californian Supreme Court found that the system of school funding was  unconstitutional because schools in wealthy neighbourhoods were getting far more funding than schools in poor neighbourhoods, where the property taxes collected were far less. This inequity in school funding violated the right of all children to a good education. The court ruled that property tax distribution should be done in a more equitable way with a transfer of property taxes from wealthy areas to poorer districts.

unconstitutional because schools in wealthy neighbourhoods were getting far more funding than schools in poor neighbourhoods, where the property taxes collected were far less. This inequity in school funding violated the right of all children to a good education. The court ruled that property tax distribution should be done in a more equitable way with a transfer of property taxes from wealthy areas to poorer districts.

People in wealthy districts objected to their taxes being used to pay for schools in other districts, rather than being used to give their own children an advantage. In addition, massive increases in house prices caused homeowners all over the state to suffer property tax increases as the market value of their homes escalated.

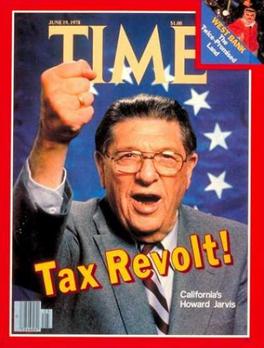

Proposition 13 was passed in 1978, with support from unhappy property owners. It reduced property taxes by an average of 57 percent and capped them at 1 percent of property values. Also property taxes could not increase as property values rose but instead were based on the last price the property was sold for. An alternative proposition that would have increased business property taxes and lowered householders taxes, particularly those of low-income elderly people, was defeated.

At the time of Proposition 13, the Californian state government had a large surplus of billions of dollars and people who voted for it were not voting to have school funding reduced but, rather for the state government to pay a higher share of school funding and other public service expenses. The state government at first made up the shortfall in revenue for schools and local government resulting from Proposition 13 but over time school funding declined.

At the time of Proposition 13, the Californian state government had a large surplus of billions of dollars and people who voted for it were not voting to have school funding reduced but, rather for the state government to pay a higher share of school funding and other public service expenses. The state government at first made up the shortfall in revenue for schools and local government resulting from Proposition 13 but over time school funding declined.

Government funding of schools in California has gone from being one of the highest in the nation to one of the lowest. Average class sizes became the largest in the nation, teachers less qualified, “the ratio of counsellors, nurses, librarians among the nation’s worst; the condition of the schools among the shabbiest.”

It was not the requirement for more equal distribution of school funding that led to lower school funding but the reduced taxation. In wealthy areas parents were able to supplement school funding with their own fundraising efforts, supplementing school budgets by hundreds of thousands of dollars. Not so in poorer areas.

The biggest winners of the property tax cuts have been large corporations because they are less likely than homeowners to buy and sell their property. Many are today paying taxes on property they acquired decades ago according to the price they paid for it then. Consequently companies such as Disney pay as little as a nickel per square foot in property taxes for its Disneyland site.

An effort to change the legislation in 1991 to have corporate property periodically reassessed, was defeated by corporate lobbying and influence and the California Chamber of Commerce continues to oppose any changes to the law.

The passage of Proposition 13 was followed by taxpayer revolts in other states and the passing of similar propositions. Between 1979 and 1984 there were over 58 similar ballot measures across the US. Consequently schools all over the nation now receive less funding from local property taxes, in fact 33 states limit how much can be collected from such taxes. As in California, state governments have generally not made up the shortfall.

The passage of Proposition 13 was followed by taxpayer revolts in other states and the passing of similar propositions. Between 1979 and 1984 there were over 58 similar ballot measures across the US. Consequently schools all over the nation now receive less funding from local property taxes, in fact 33 states limit how much can be collected from such taxes. As in California, state governments have generally not made up the shortfall.

In most states corporations were able to reduce their tax burdens as a result of new property tax regulations. In addition cities used tax breaks to attract corporations which deprived schools of even more money and diverted hundreds of millions of dollars from schools to corporations. According to a National Education Association (NEA) report, subsidies and tax breaks cost Ohio schools $102 million in 1999 and Texas schools $52 million per year.

In 1974 the Louisiana state government gave companies a ten year exemption from property taxes for new manufacturing plants and extensions to existing plants. This saved companies $2.5 billion during the 1980s, reducing school funding by almost $1 billion, that is $100 million per year. By the 1990s Louisiana was “ranked last among the fifty states in its number of high school graduates, forty-ninth in its poverty rate, forty-seventh in its rate of adult illiteracy”.

By 1990, the share of property taxes contributed by corporations nationwide in the US had declined to 16 percent compared with 45 percent in 1957. In addition, Proposition 13 was said to have heralded a widespread movement to lower taxes from all levels of government which helped get Ronald Reagan elected as president in 1980. During his term of office, the federal government also significantly cut back funding of public schools.

As a result of this unwillingness on the part of corporations to pay taxes, the US spends a smaller share of GDP on education than all other large industrialised nations apart from the UK, which spends a similar proportion of GDP.

Corporations that want to minimise the tax they pay towards public schools, pay lip service to supporting public education whilst lobbying against the raising of taxes that could be used for that purpose. Corporate executives and managers are able to give their own children educational advantages by sending them to private schools or living in affluent suburban neighbourhoods where there is a high local tax base, but are unwilling to fund adequate education for other children. For example, “executives of General Motors, … who have been among the loudest to proclaim the need for better schools, have been among the most relentless pursuers of local tax abatements.”

As corporations pay less and less taxes towards public schooling they invest token amounts in sponsorships, grants and scholarships to earn the reputation of being school benefactors. “Corporations starve local and state communities for financial resources, then pose as the savior for the cash strapped common good”. They ensure that schools are dependent on their advertising and public relations-based educational materials, as well as their largess, which they can bestow discriminately to those who run schools the way they want. Schools no longer have the secure long-term funding that once came from taxes.

If you have any examples or updates you would like to contribute please email them to me and I will add them here. Please give references for where you sourced the information.