Financial deregulation exposes ‘the economy to the vortex of speculative capital movements, that is, to the flows of short-term finance in search of quick profits.’ For example, only ten percent of transactions in currency markets represent actual trade. The rest is largely speculative. Investors today prefer to invest in mutual funds or make short-term investments in companies gambling against movements on the stock market, rather than long-term investments in production of goods and services.

Financial deregulation exposes ‘the economy to the vortex of speculative capital movements, that is, to the flows of short-term finance in search of quick profits.’ For example, only ten percent of transactions in currency markets represent actual trade. The rest is largely speculative. Investors today prefer to invest in mutual funds or make short-term investments in companies gambling against movements on the stock market, rather than long-term investments in production of goods and services.

During the 1990s many investors speculated in East Asia, investing billions of dollars in real estate, the stock market, banks and corporations so that market values soared unrealistically. At the first sign of falling stock markets there was an investor panic. Foreign capital was rapidly withdrawn from those same countries, causing a crash that involved company bankruptcies, widespread unemployment, devaluation of currencies and shortage of foreign exchange. To attract foreign investment after such a rout the IMF made the countries raise their interest rates to ridiculously high levels – up to 80 percent – which caused havoc with property values and industrial production.

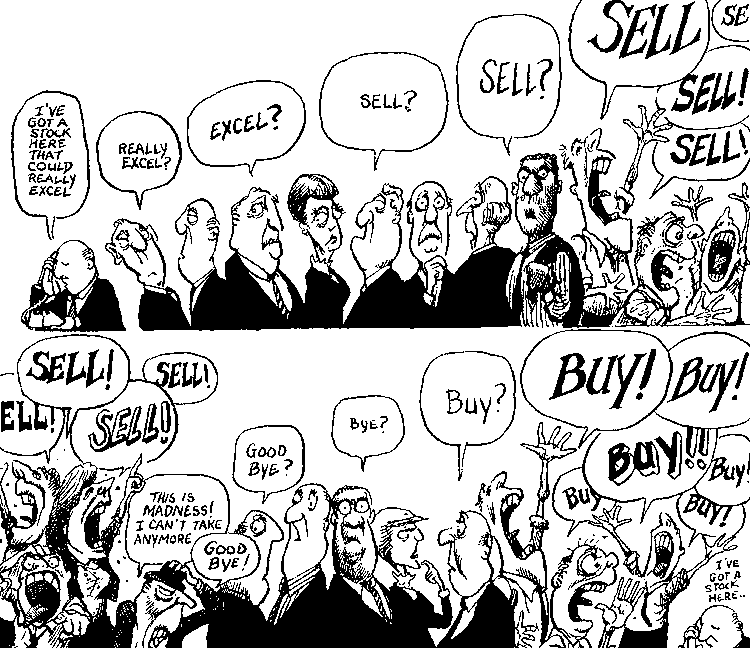

The response of speculators in markets is quick and herd-like. Reactions are not well thought out nor fully informed. Speculators panic and don’t want to be left behind once capital movements begin. The value of what one invests in will go up if

others also want to invest in it, and down if they don’t. The trick is to get out before everyone else does. Such decisions are not made on the basis of what is good for a nation’s economy but rather on the basis of trying to second guess other investors. This merely serves to create economic instability and does little to foster productive long-term investment, because capital that could otherwise be used in production is used for gambling on the economies of various countries. The rapid inflow and outflow of speculative finance can cause crises in national economies. David Korten, once a senior advisor to USAID, says of these speculators:

Each day, they move more than two trillion dollars around the world in search of quick profits and safe havens, sending exchange rates and stock markets into wild gyrations wholly unrelated to any underlying economic reality. With abandon they make and break national economies, buy and sell corporations and hold politicians hostage to their interests.

Thomas Friedman uses the term the ‘Electronic Herd’ to refer to ‘the faceless stock, bond and currency traders sitting behind computer screens all over the globe, moving their money around with the click of a mouse from mutual funds to pension funds to emerging market funds’ and the ‘big multinational corporations who now spread their factories around the world, constantly shifting them to the most efficient, low cost producers’. It is they who have become the final arbiters of ‘good’ government policy.

Thomas Friedman uses the term the ‘Electronic Herd’ to refer to ‘the faceless stock, bond and currency traders sitting behind computer screens all over the globe, moving their money around with the click of a mouse from mutual funds to pension funds to emerging market funds’ and the ‘big multinational corporations who now spread their factories around the world, constantly shifting them to the most efficient, low cost producers’. It is they who have become the final arbiters of ‘good’ government policy.