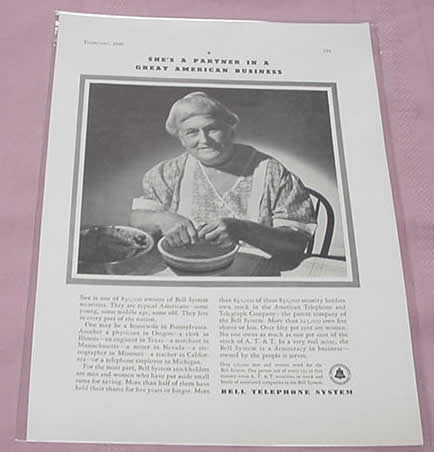

The privately owned telephone utility company, AT&T, pioneered the idea of ‘investor democracy’. Rather than the corporation being owned by a few wealthy men, AT&T emphasised the number of its shareholders—hundreds of thousands—to portray itself as an organisation owned by the people. It depicted its shareholders as ordinary people, including workers and housewives. It’s advertisements were headlined ‘Democracy’ and ‘Our Stockholders’ and one, showing an older country woman shelling  peas, was headlined ‘She’s a partner in a great American business’. The message was that AT&T was owned and controlled by the people it served and so, far from being a private monopoly, it was virtually a public company. AT&T deliberately attracted a broader base of shareholders than most other corporations. However, most AT&T shareholders owned only a few shares whilst five percent of the shareholders owned 50 percent of the shares.

peas, was headlined ‘She’s a partner in a great American business’. The message was that AT&T was owned and controlled by the people it served and so, far from being a private monopoly, it was virtually a public company. AT&T deliberately attracted a broader base of shareholders than most other corporations. However, most AT&T shareholders owned only a few shares whilst five percent of the shareholders owned 50 percent of the shares.

The ploy was so attractive that other large corporations, such as US Steel, General Electric and Du Pont, also sought to emulate AT&T in the 1920s, distributing shares widely and then promoting themselves as industrial democracies. Employee stock owning programs helped this goal. General Motors advertised that ‘More than 68,000 investors own General Motors and divide its earnings. They live in every state in the Union, in Canada and in 16 foreign lands. Of these General Motors stockholders, 58,000 own 100 shares or less. More than 18,000 stockholders are women—mothers, sisters, wives’.

The electricity companies also encouraged the public to buy shares in their utilities in the 1920s. Originally this was to raise money, but it soon became a very useful public relations tool. Wide share ownership by the community could be promoted as a substitute for public ownership of electricity systems. ‘In the new language of utilities, ‘real public ownership’ meant customer ownership, not political ownership.’

The electricity companies also encouraged the public to buy shares in their utilities in the 1920s. Originally this was to raise money, but it soon became a very useful public relations tool. Wide share ownership by the community could be promoted as a substitute for public ownership of electricity systems. ‘In the new language of utilities, ‘real public ownership’ meant customer ownership, not political ownership.’

Power company literature frequently associated advocacy of public ownership with socialism and Bolshevism. And it repeatedly implied that private power companies were owned by the public because members of the public owned stock in the utilities, or had bank deposits and life insurance with banks and insurance companies that invested in utility securities.

The electricity companies in the US recognised in the 1920s that wider share ownership would mean more people would have a self-interest in the advantage of the utilities. Customers who bought securities became ‘an army of friends for utilities’.

Once these plain people added their voices to the hue and cry of denunciation of the utility raised by the professional agitators, socialists, and public ownership advocates. Today they say with pride, ‘This is my company; I’m one of its stockholders!’

The National Electric Light Association (NELA), a coalition of private electricity companies, called broadening share ownership ‘an extraordinarily clever and astute flank attack upon the forces which advocate and fight for public ownership’. Selling shares to consumers created, according to NELA’s customer ownership committee, ‘A stalwart army of sound-thinking owners of private property’ that was ‘the nation’s greatest defense against socialism or communism.’

NELA argued that ‘customer ownership’ provided real public ownership through direct investment, so public ownership through government was unnecessary. Of course these ‘customer owners’ could not vote at general meetings, since it was mainly bonds, securities or non-voting stock that they invested in. Nor were they otherwise able to exercise any ownership control over the companies. In reality all they were doing was lending money to the power companies.

The power companies even courted children as ‘customer owners’. Not only did it encourage children to be future investors but it gave a sentimental value to the stock so that parents who bought such stock in their children’s name were less likely to sell it. The Chair of one of NELA’s Customer Ownership Committees wrote to NELA’s managing director in 1925:

I believe that you appreciate the great psychological value of having minors as stockholders… I know that it has been your personal experience if you once buy something for your children, and place it in their names, it immediately takes on a sentimental aspect that the balance of your properties do not possess… This is one field of investment that is of importance to us, for a new crop of investors is being born every day.

The share market crash that ushered in the Great Depression put many middle-class investors off share investment for many years. The New York Stock Exchange tried to win them back in the early 1950s through promoting the idea of ‘people’s capitalism’ through share ownership. They advertised that share investment was the way to ‘own your share of America.’ George Keith Funston, head of the Exchange (1951-1967), was a man with ‘a powerful voice and a flair for public relations’ and the one who came up with the term ‘people’s capitalism’. During the cold war years he argued that investing in American companies was a way of fighting Communism. The numbers of shareholders tripled during his term of office.

The share market crash that ushered in the Great Depression put many middle-class investors off share investment for many years. The New York Stock Exchange tried to win them back in the early 1950s through promoting the idea of ‘people’s capitalism’ through share ownership. They advertised that share investment was the way to ‘own your share of America.’ George Keith Funston, head of the Exchange (1951-1967), was a man with ‘a powerful voice and a flair for public relations’ and the one who came up with the term ‘people’s capitalism’. During the cold war years he argued that investing in American companies was a way of fighting Communism. The numbers of shareholders tripled during his term of office.

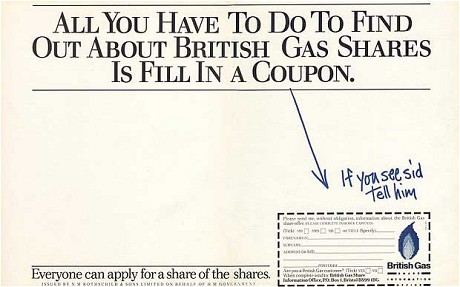

In Britain during the 1980s privatisation was partly justified on the grounds of widening share ownership in the community. This was supposed to establish, in the words of one Conservative minister, ‘a new breed of owners’ and have ‘an important effect on attitudes’, thereby breaking down ‘the divisions between owners and earners’.

The Confederation of British Industry (CBI) formed a wider share ownership taskforce and the government formed the Wider Share Ownership Council. The float of shares in privatised companies was said to have ‘given a boost to popular capitalism unimaginable in the pre-Thatcher era’ and the profits made by millions of small investors made it ‘difficult to question the logic underpinning privatisation’.

Conservatives used the rhetoric that privatisation would spread wealth more widely in the community and create ‘real public ownership’ of government enterprises to sell pri vatisation to the electorate and to take away public ownership. Shares for British Telecom and British Gas, for example, were sold using massive advertising campaigns, to gain public support for the sale and to counteract union opposition. And as more pension funds invested in privatised corporations, workers were ‘led to believe that [strike] action against these companies’ would threaten their pensions.

vatisation to the electorate and to take away public ownership. Shares for British Telecom and British Gas, for example, were sold using massive advertising campaigns, to gain public support for the sale and to counteract union opposition. And as more pension funds invested in privatised corporations, workers were ‘led to believe that [strike] action against these companies’ would threaten their pensions.

Shares were sold below market value so that new shareholders could experience an immediate financial gain when the shares were floated and the price increased. This increased the popularity of privatisation amongst those who benefited or hoped to benefit from future share floats, and was seen by some as a deliberate bribe. ‘The fact that huge values had been transferred from taxpayers to shareholders was not deemed troublesome.’

In 1991 John Redwood, minister for corporate affairs, described the changing nature of the stock exchange:

The Stock Exchange of the 1960s was all top hats, champagne at lunch, double-barrelled names and invitations to the select few to become clients. The market of the 1990s is all filofaxes and mobile phones, long working days and draught larger on the pavements… but does Middle England recognise the Stock Exchange as its own?

The business-serving government wanted Middle England to identify with the Stock Exchange and Redwood called ‘for new legions of private shareholders to come forward and join the long march towards the new shareholder democracy’.

There was an increase in Conservative voters amongst the new shareholders of the utilities. ‘Prime Minister Thatcher, as she then was, made no secret of her desire to alter the balance of political power by creating a ‘share-owning democracy’, with more shareholders than there were trade union members’.

However, the new shareholders quickly realised their gains (made at the expense of taxpayers) by selling their shares. In the electricity industry, for example, the number of individual shareholders dropped from 7 million at privatisation in 1990 to 2 million in 1997 and is still falling.

In Australia, Prime Minister John Howard, announced in 1998 the goal of making Australia ‘the greatest share-owning democracy in the world’ as a way of justifying the privatisation of the remaining two thirds of Telstra that was still owned by the government: ‘I can’t think of a better way of enhancing Australians ownership than to let Australians buy something’. Senator Richard Alston argued that the public would actually have more control over the way Telstra was run once it was fully privatised. ![]()

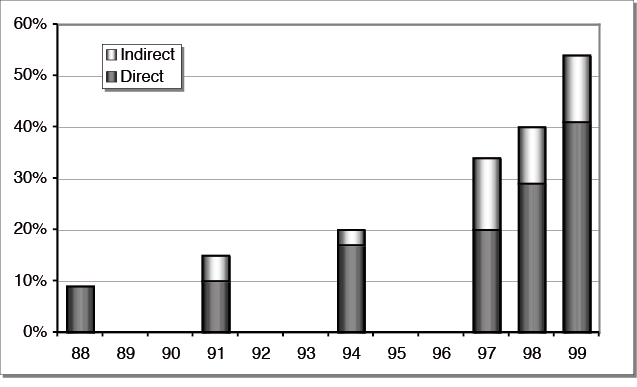

Through the 1990s the number of Australians who owned shares increased as insurance companies demutualized, public enterprises were privatised with share floats (see figure 3 below), and because of compulsory superannuation.

Figure 3: Ownership of Shares in Australia

NB: Figures don’t include compulsory superannuation system

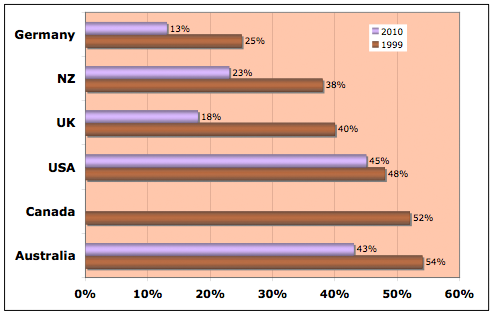

When Australia surpassed Canada and the US in 1999 with its percentage of the adult population with shares (see figure 4 below), The Australian ran a feature article with the headline ‘We lead the world in owning shares, Great Aussie stockocracy’. The Australian Financial Review ran an editorial in 2000 entitled ‘We are all capitalists now’, extolling ‘the great transformation of the Australian economy: the rise of the worker-rentier class’ which had come about, largely through privatisations of government enterprises. It argued that most adult Australians had become ‘stakeholders in capitalism’, either through direct share ownership or indirectly through managed funds and private superannuation funds.

Figure 4: Percentage of Adult Population Owning Shares

NB: Australian figures don’t include compulsory superannuation system

In Germany, share ownership trebled between 1991 and 1995. Then in 1996 when shares in Deutsche Telekom (DT) were offered to the public they were promoted as ‘people’s shares’. ‘This exercise in people’s capitalism created more new shareholders than any other single event’ causing the number of shareholders to double again by 1997. The number of shareholders increased by 500,000 in 1999 as investment clubs proliferated.

By 2000 The Economist had reported that ‘Germany was share-crazy. Gone is the image of a nation dourly stuffing its spare cash into a safe-as-houses, low-interest Sparbuch savings account. Money poured into initial public offerings… Germans were opening share-dealing accounts – online, naturally – at a furious rate.’ It noted that evidence of a ‘spreading equity culture’ was clear in the media: ‘Since last autumn a live, four-minute bulletin on the Tops und Flops of the day, that runs just before the evening news, has become a fixture on national public television.’

The French government also extolled the benefits of wider share ownership during the 1980s when it was proposing to sell off government-owned industries. It ran ‘weeks of slick television advertisements, often featuring glamorous models, that extol share ownership’. Its sale of shares in glass manufacturer Saint-Gobain was promoted in a $6 million advertising campaign that included television ads that sold the shares ‘the way U.S. companies market soap or toothpaste… A network of more than 20,000 banks and post offices pushed shares’ to customers conducting their normal business.

Edouard Balladur, the Finance Minister declared a success his campaign for ‘popular capitalism’ when floats of these industries were heavily oversubscribed by people wanting to buy shares in them. As in the UK, small shareholders quickly sold their shares when the price went up. Even then, the share floats could be seen as a success in that ordinary people had tasted ‘the fruits of capitalism’, which some said was one of the aims of the exercise – an effort to lure people away from socialism. The manager of Drexel Burnham Lambert in Paris pointed out ‘The privatization campaign is making capitalism seep down through the social structure of France.’