Grover George, president of the American Shareholders Association (ASA) claimed:

When a wage worker enters the investor class through a work-based 401(k) [retirement accounts that can be invested in the stock market]… his opinions on vouchers, free trade, and entitlement privatization are no likelier to change overnight than his party affiliation. But as his plan assets grow, so do his expectations for their performance…. over time, he actively seeks sources of information that will maximize his efficiency in his new vocation: that of a capitalist. It is this pursuit that changes his opinions on a variety of partisan and policy questions to favor market-based solutions and their political advocates.

Heritage Foundation's Jack Kemp pointed out that if everyone owned stock they would all demand policies from government that encouraged economic growth and business opportunities. The Australian Financial Review similarly argued that the new generation of ‘worker shareholders’ has a ‘reason to scour the stock exchange tables every morning’ and ‘will inject a powerful dose of support for market capitalism, free markets, minimal government, internationalisation and efficient management into the body politic’.

Heritage Foundation's Jack Kemp pointed out that if everyone owned stock they would all demand policies from government that encouraged economic growth and business opportunities. The Australian Financial Review similarly argued that the new generation of ‘worker shareholders’ has a ‘reason to scour the stock exchange tables every morning’ and ‘will inject a powerful dose of support for market capitalism, free markets, minimal government, internationalisation and efficient management into the body politic’.

As more people own shares, particularly through pensions and mutual funds, so the readership of business papers and magazines has increased dramatically. By 1997 the Wall Street Journal had become the daily paper with the highest circulation and magazines such as Money, Business Week, Forbes and Fortune were likewise doing very well.

As more people own shares, particularly through pensions and mutual funds, so the readership of business papers and magazines has increased dramatically. By 1997 the Wall Street Journal had become the daily paper with the highest circulation and magazines such as Money, Business Week, Forbes and Fortune were likewise doing very well.

A couple of years later as the number of Australian shareholders increased the ABC news had replaced its sports anchorperson with a business reporter and the best selling book was Rich Dad, Poor Dad, which was about how to make money through investment. John Budd, ABC’s national editor called Business and Finance ‘the main participation sport for most Australians’. In addition finance programs were increasingly featured on popular television channels. Adele Horin in the Sydney Morning Herald noted:

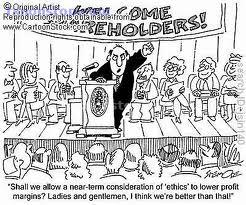

The spread of share ownership to the middle class is changing how we spend our time, what we talk about, celebrate, worry about. It has even changed what we watch on television… The perspective of a shareholder is different from that of a citizen without a portfolio. Mesmerised shareholders can begin to believe rising unemployment is good because it boosts share prices, and applaud a tax system that continues to treat shares and dividends far more favourably than wages. Support for socially responsible corporate behaviour – let alone progressive policies such as a 36-hour working week or paid maternity leave – can evaporate under threat of a sliding share price.

In the US, in an article entitled ‘Your Politics vs. Your Portfolio’, Dennis Fox observed: ‘It now matters to more people whether the Dow is up or down, whether the Nasdaq’s latest slide is just temporary… its hard to maintain an anti-corporate political stance when your computer keeps a running tab of your ever-changing net worth.’

In the US, in an article entitled ‘Your Politics vs. Your Portfolio’, Dennis Fox observed: ‘It now matters to more people whether the Dow is up or down, whether the Nasdaq’s latest slide is just temporary… its hard to maintain an anti-corporate political stance when your computer keeps a running tab of your ever-changing net worth.’

Richard Nadler did a study for the neoconservative think tank, the Cato Institute, entitled The Rise of Worker Capitalism. It included a commissioned survey showing that people who invested in shares were more likely to identify as Republicans than non investors; this was true even of minorities and single women – not traditionally strong Republican supporters. This meant, he argued, that the rise of share ownership, even when through pension funds, had shifted the political balance in favour of pro-business policies: ‘Hypothetically, as workers accumulate capital, their support for free-market and pro-growth policy reforms will increase. The available evidence suggests that this is precisely the case.’

George Melloan argued in the Wall Street Journal that ‘the advent of people’s capitalism fulfils what for many years has been a Wall Street dream, an era when most Americans would have a stake in American business and would thus be sympathetic to the needs of a capitalist system.’ He suggests that this was reflected in US politics in Clinton’s attempt to ‘co-opt the free market ideals of the Republican Revolution’.

A survey commissioned by the ASA found that ‘mass ownership of financial assets has midwifed a new birth of freemarket opinion’. It found that Republican affiliation correlated with the length of time that a person had been in a retirement plan. After 10 years those in a 401(k) plan were 7 percent more likely to support a corporate tax cut, 9 percent more like to oppose a minimum wage, 10 percent more likely to support school vouchers, and 17 percent more likely to support Social Security privatisation than non investors. They were also more likely to support free trade, death-tax reduction and market-based energy policies. Those owning stocks directly, as opposed to indirectly via pension funds, developed a capitalist ideology even more rapidly.

The Wall Street Journal claimed that the 1980s criticism of greed, shown in Oliver Stone’s movie ‘Wall Street’, had disappeared by the 1990s as everyone indulged in share ownership:

Today, even our lowest earners see that the Decade of Greed and its blockbuster sequel, the 1990s, have benefited just about everyone. Workers nowadays don’t have time to hate Gekko, or his 1990s equivalents… They are busy puffing their own stogies and mounting their own shareholder revolution.

A Gallup poll in 1999 found that shareowners were more likely to support cuts in capital gains tax as did Rasmussen Research, which found that the result held for all demographic groups. Similarly a Pew Research Center survey of attitudes found in 1999 that middle-income share investors were slightly more skeptical of government spending and regulation than other middle income non-investors.

A Gallup poll in 1999 found that shareowners were more likely to support cuts in capital gains tax as did Rasmussen Research, which found that the result held for all demographic groups. Similarly a Pew Research Center survey of attitudes found in 1999 that middle-income share investors were slightly more skeptical of government spending and regulation than other middle income non-investors.

‘It is this educating tendency of capital ownership that the GOP has been slow to grasp’ according to Nadler, who urges the Republican Party ‘to nurture the movement toward worker capitalism’ for this reason. He argues:

A young worker starts his 401(k) account not because he identifies with the political Right, but because he wants to save for retirement. Yet by deferring some consumption in favor of savings and investment, he has in fact become a capitalist. The return on his broad-based mutual funds will depend on policy decisions that unite him with more experienced capitalists, whose interests may differ from his more in quantity than in kind. And to the extent that his portfolio becomes important in the life of his family, that unity will increase.

Peter Du Pont, a former governor of Delaware and policy chairman of the National Center for Policy Analysis claims:

The implications of our emerging democratic capitalism are enormous. Once-impossible dreams of ‘every man a capitalist’ now appear attainable. If most workers and retirees become heavily invested in American business, the political fallout will begin with termination of class-warfare rhetoric and politicians who rely on such demagoguery.

Padraic McGuinness, an Australian free market ideologue, argued in his weekly newspaper column that ‘both the ideological and organisational underpinnings of Labor are being undermined by the spread of people’s capitalism… it is certain that the already moribund notion of “them against us”, capitalists versus workers, will be thoroughly dead and buried within the next few years…As share ownership spreads there will be more and more questioning of taxes…Share-owning employees also will become more determined than others in their companies to pull their weight, and that abuse of work practices and overmanning should cease.’

Padraic McGuinness, an Australian free market ideologue, argued in his weekly newspaper column that ‘both the ideological and organisational underpinnings of Labor are being undermined by the spread of people’s capitalism… it is certain that the already moribund notion of “them against us”, capitalists versus workers, will be thoroughly dead and buried within the next few years…As share ownership spreads there will be more and more questioning of taxes…Share-owning employees also will become more determined than others in their companies to pull their weight, and that abuse of work practices and overmanning should cease.’

In Western Europe, a growing ‘shareholder culture’ is also ‘beginning to change the politics’, according to George Melloan in the Wall Street Journal. He argues that whilst corporations were once regarded as ‘national champions’ to be regulated so that they would serve the public interest, now their managers are free to ‘resist such pressures on grounds that their primary duty is to shareholders.’

People’s capitalism will demand that politicians consider the interest of shareholders, rather than focusing on the presumed needs of pressure groups. The power of unions is already slipping as a new generation of more individualistic Europeans comes on the scene.

Shawn Tully, in Fortune magazine argued in 1987 that privatisation, ‘the hot new trend in business… sweeping Europe’, was ‘creating a people’s capitalism that will almost certainly change ordinary citizens’ attitudes toward government and business. As share owners, Europeans will be more likely to support the free-market policies that so many governments have shifted to in recent years. The new capitalists may be even more understanding when managers use their new flexibility to cut costs and, sometimes, jobs.’