Owning shares in a company does not give small shareholders any control in the company. They are not owners, in any real sense, but merely investors. Shareholders elect the board of directors, which in turn hires the top management of a company. They also get to vote on major changes in direction of the company but little else.

The decisions at annual general meetings generally fall into four categories: election of directors, selection of accountants, approval of changes to executive pay and benefits, and shareholder resolutions. Only the last category is initiated by shareholders and such resolutions are generally opposed by management. Executive compensation resolutions are deliberately made too complex for the average shareholder to understand.

Because few people are able to attend company meetings most votes are done by mailed proxies. Proxies enable shareholders who do not attend meetings to appoint someone else to vote for them at the meeting. The company sends them forms to enable them to do this. However, soliciting proxies from shareholders is expensive and whilst management can use company funds for this, shareholders who want to solicit proxies have to pay for it themselves. Needless to say, this seldom happens. Corporate management also controls the flow and content of information to shareholders, including reports that are done largely for shareholder relations purposes.

Although theoretically shareholders elect the board of directors, what generally happens in practice is that the CEO chooses the board by nominating who should be on it and not providing alternatives for shareholders to vote for. Board members are then beholden to the CEO for their positions. ‘Increasingly companies have adopted staggered boards, with only one-third of the seats filled each year, so that any organized opposition amongst shareholders cannot control the board after a single vote.

Although theoretically shareholders elect the board of directors, what generally happens in practice is that the CEO chooses the board by nominating who should be on it and not providing alternatives for shareholders to vote for. Board members are then beholden to the CEO for their positions. ‘Increasingly companies have adopted staggered boards, with only one-third of the seats filled each year, so that any organized opposition amongst shareholders cannot control the board after a single vote.

When it comes to election of the board of directors, any shareholder wishing to propose alternative candidates has to pay the expense of mailing proxy forms and campaign literature to many thousands of shareholders. In contrast company management can use company funds to hire firms that specialise in contacting shareholders personally and persuading them to send in their proxies for a particular result. Ralph Nader and Joel Seligman noted in 1983: ‘company insiders have so totally dominated the proxy machinery that corporate elections have come to resemble the Soviet Union’s ‘communist ballot,’ on which only one slate of candidates appears.’

The people nominated by CEOs for board membership tend to be senior executives of other companies (sometimes retired), many with only nominal shareholdings in the company themselves. Lewis Braham writes in Business Week:

Americans like to believe we have shareholder democracy. The people who own a company have a say in how it’s run. Right? Well, just try to win a seat on a corporate board without management backing. A tangle of rules and procedures stifle all but the wealthiest and most persistent voices.

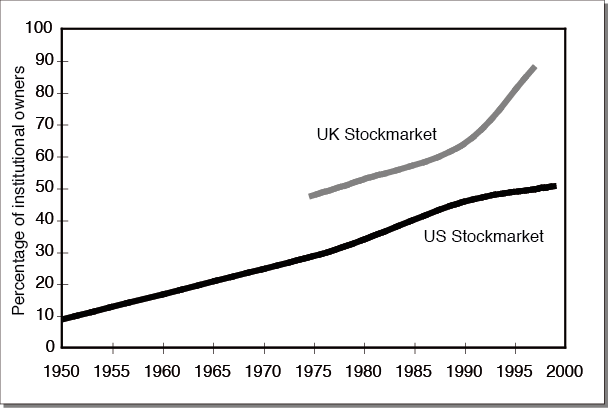

In addition institutional investors tend to vote with management, further reducing the say of individual shareholders. In the US and the UK institutional investors dominate stock holdings (see Figure 1 below). In the US pension funds alone owned 25% of all corporate stock in 1990 and the largest 20 owned 16 percent of shares in the 10 largest corporations. Such institutional investors have become permanent shareholders because they don’t move their investments around. This is partly because their holdings are so large that such movements would affect the share price unfavourably for them.

Figure 1: Institutional Ownership of Corporate Equity

Martin Lipton, a New York Lawyer, noted in the New York Times in 1987:

Corporate securities in the hands of large institutions in effect removes all public say by smaller shareholders. The old concept of shareholders’ democracy related to a time when there was a diverse group of shareholders not dominated by any small group that has a single interest. Today the shareholders of corporations are dominated by a small group of institutions, all of whom have only one interest – to realise short-term gains.

In Australia, the number of small shareholders has been falling since 2002 (long before the global financial crisis) while shareholdings of institutions have been increasing. Three quarters of shares in the top 20 listed companies are owned by 3 percent of shareholders.

Similarly, in Britain, share ownership has become more concentrated in the hands of financial institutions such as banks, pension funds, insurance companies and investment trusts. Insurance companies own a third of all shares in Britain. Although the number of people owning shares in Britain increased during the 1980s (see figure 2 below) the actual proportion of shares in listed British companies owned by individuals, as opposed to institutions, decreased (see figure 3 and figure 4).

Not only do institutional investors, including fund managers, tend to vote with corporate management but so do brokers, who are able – in the US – to vote on behalf of their clients if they don’t have instructions from them.

Figure 2: Percentage of Population

|

Reference: C. Robinson. ‘Pressure Groups and Political Forces in Britain’s Privatisation Programme’, p. 8; Steve Thomas, ‘The Privatization of the Electricity Supply Industry’, in John Surrey (ed) The British Electricity Experiment, London, Earthscan Publications, 1996, p. 41; J. Flynn. ‘Will Britain Ever Be a Nation of Stock-Keepers?' Business Week 19 August 1996, p. 42; ‘Share Ownership: A Report on Ownership of Shares as at 31st December 2001,’ Newport: Office for National Statistics, 2002, p. 9

Figure 3: Percentage of British shares owned by Individuals

|

Figure 4: Distribution of Ownership of UK Shares

What is more some companies have two classes of shares that allow voting power to be concentrated in the hands of loyal executives. Owners of the so-called ‘Supervote stock’ get more votes per share or the right to elect the majority of directors. The tactic is used by companies that want to raise capital from investors but at the same time want to retain full control of the company. Family companies have traditionally used dual-class shares but the practice is spreading.

What is more some companies have two classes of shares that allow voting power to be concentrated in the hands of loyal executives. Owners of the so-called ‘Supervote stock’ get more votes per share or the right to elect the majority of directors. The tactic is used by companies that want to raise capital from investors but at the same time want to retain full control of the company. Family companies have traditionally used dual-class shares but the practice is spreading.

The same effect can be achieved through holdings within shareholdings. ‘News Corporation is controlled by Cruden Investments, Rupert Murdoch’s very private company – he even bought out his sisters.’ Whilst shares in News Corporation are publicly traded, it is Cruden Investments that determines the decisions that matter.

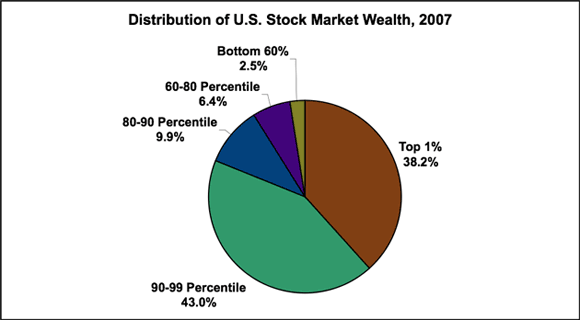

Both the level of control derived from the ownership of shares and the extent to which share ownership has been spread to lower income brackets have been misrepresented. Although more people own shares, the majority of shares are still owned by very few people. One percent of those who own shares owned 38 percent of them in 2007 and the top ten percent owned more than 80 percent of all shares (see Figure 5 ).

Figure 5: Distribution of shares by value in the US in 2007

Similarly, despite widening share ownership in Australia, the richest 10 percent own 90 percent of the shares and the richest 1 percent own almost 60 percent of the shares (see Table below).

Table: Distribution of wealth and shares in Australia 1993-1998

| Wealth in 1993 | Wealth in 1998 | Shares in 1998 | |

|---|---|---|---|

| Wealthiest 10 percent | 43.5% | 48% | 90% |

| Wealthiest 1 percent | 12% | 15% | 60% |