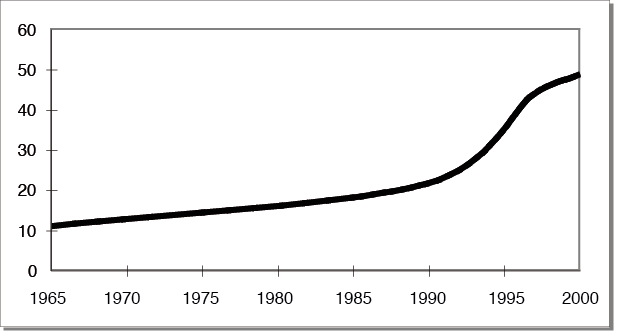

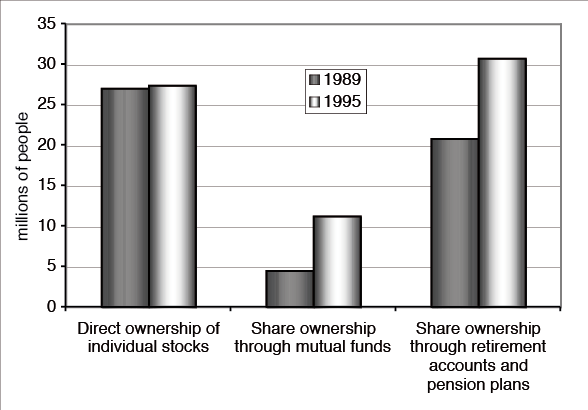

There has been a rapid growth in share ownership in the US over the last two decades (see Figure 1 below) due to the increasing role of shares in pension plans from the 1980s and the rise of mutual funds in the early 1990s (see Figure 2 below). However these new shareholders hold their shares indirectly. When people invest in mutual funds they invest in a managed portfolio of various investments including stocks. The same is true of pension funds. It is the fund mangers who have the voting rights at shareholders meetings.

Figure 1: Percentage of Householders Owning Shares in the USA

Figure 2: Increasing share ownership in US 1989-1995

People were attracted to mutual funds though the nineties because of the high returns compared with bank interest, fuelled by rapidly increasing share prices on the stock market which in turn was fed, in part, by the growth of investment by mutual funds. Mutual funds held $3 trillion worth of bonds and stock in 1999 compared to little more than $100 million in 1985. Two thirds of the holdings of mutual funds represented household investment.

During the 1980s the nature of pension plans changed in the US, with the encouragement of the Reagan administration. ‘Defined benefit’ plans that paid pensions according to an individual’s salary and years of service, gave way to ‘defined contribution’ plans, referred to as 401(k) accounts, that paid pensions according to the investment growth of set contributions (usually from both employer and employee) which was often invested in stocks. This meant that pensions grew faster when the stock market boomed but could also lose value when it went down. The risk associated with losses to the pension fund moved from the employer to the employee.

During the 1980s the nature of pension plans changed in the US, with the encouragement of the Reagan administration. ‘Defined benefit’ plans that paid pensions according to an individual’s salary and years of service, gave way to ‘defined contribution’ plans, referred to as 401(k) accounts, that paid pensions according to the investment growth of set contributions (usually from both employer and employee) which was often invested in stocks. This meant that pensions grew faster when the stock market boomed but could also lose value when it went down. The risk associated with losses to the pension fund moved from the employer to the employee.

‘Defined contribution’ pension plans were a way of ensuring wider share awareness amongst workers, even though the ownership was indirect. The Chicago-based magazine Pensions & Investment Age argued that the growth of stock-holding pension plans had a role to play in the rise of ‘People’s Capitalism’. They would ensure that employees would ‘assume more responsibility for their corporate assets’ and ‘come to better understand free enterprise’.

By 1998 55 million workers owned shares through their pension funds. The Wall Street Journal suggested the development represented an ‘emancipation’ of workers ‘from the paternalism’ of defined benefit plans; an emancipation that enabled them to ‘become risk-taking capitalists’. Jeffrey Garten, the Dean of the Yale School of Management, portrayed it as ‘a culture where people invest in markets rather than relying on government support’ and John Hood made similar claims in his book Investor Politics. Hood is president of the John Locke Foundation, a Visiting Fellow at the Heritage Foundation and a regular media commentator. He argued that ‘the goal should be to replace government entitlement programs with a system that exempts savings and investment from taxation’ so as to ‘allow individuals and families to invest their own money, rather than expecting the government to ‘invest’ it for them…’

Despite the preponderance of indirect shareholding, conservatives hailed the development as a confirmation of the legitimacy and widespread beneficence of capitalism. According to Richard Nadler, chair of the Republican Ideas Political Committee and executive director of American Shareholders Association: ‘This resulted in the greatest dispersion of capital ownership in human history.’

Australians too were encouraged to change their superannuation holdings from defined benefit plans in the 1990s to a choice of investment portfolios involving a greater or lesser proportion of shares. In 1980, 38 percent of workers had defined benefit superannuation plans. In 2005 workers had the further choice of opting out of industry or employer-based superannuation schemes and choosing from a range of commercial superannuation schemes. By 2008 that had declined to 3 percent with another 12 percent having a combination of defined benefit and defined contribution (like 401K) plans.

President George W. Bush pledged ‘to add a private, market-based component to retirement security through ‘personal retirement accounts’.’ Following his re-election in 2004 he set about implementing this program. The idea is for a portion of the payroll taxes that are used to pay for Social Security to be diverted  into private investment accounts that would grow according to the value of the shares, property or bank accounts it is invested in. In this way the money available to people when they retire would be based on the market growth of their investment, which advocates say would be more than they would receive through Social Security. Since these taxes were being used to fund current retirees, the government claimed it had to borrow trillions of dollars to pay for the scheme over ten years.

into private investment accounts that would grow according to the value of the shares, property or bank accounts it is invested in. In this way the money available to people when they retire would be based on the market growth of their investment, which advocates say would be more than they would receive through Social Security. Since these taxes were being used to fund current retirees, the government claimed it had to borrow trillions of dollars to pay for the scheme over ten years.

In one of its backgrounders, entitled ‘How to Fix Social Security’, the Heritage Foundation argued that personal retirement accounts were ‘the only solution that will give future retirees the opportunity to receive an improved standard of living in retirement. These accounts would give them more control over how to structure their income and allow them to build a nest egg…’

The logic of the proposed reforms is difficult to understand. The rationale was that in 40 years or so Social Security may not have the funds to cover people’s pensions. Funds invested in the stock market, however, were presumed to grow much faster than Social Security funds invested in Treasury bonds, and therefore would make up the shortfall. However, Social Security funds were invested in low yielding Treasury bonds because they are safe and the income is guaranteed. The stock market, on the other hand, is volatile and highly risky. Otherwise, ‘the government could erase Social Security’s entire projected deficit by selling bonds at 3 percent and buying stocks that yield 7 percent.’ Economist and New York Times columnist, Paul Krugman, noted that, in effect, what the government was proposing to do was ‘borrow heavily and put the money in the stock market’ via private retirement accounts. That is, the privatisation of social security involved the ‘government borrowing to speculate on stocks’.

Because this was an idea that did not have popular support, and few people believed that Social Security was facing a future crisis, the Bush camp was ‘raising millions of dollars for an election-style campaign’ to promote it in what was expected to be ‘the most expensive and extensive public policy debate since the 1993 fight over the Clinton administration’s failed health care plan.’ However this time business was on the side of the president. The National Association of Manufacturers (NAM) was ‘leading the charge for business interests’ with an Alliance for Worker Retirement Security, consisting of 40 NAM members headed by Derrick Max, to back the president’s social security privatisation plan.

Another business coalition, which included NAM and was also being coordinated by Derrick Max, was the Coalition for the Modernization and Protection of America’s Social Security (Compass). Compass is an umbrella group that includes other business groups such as The Business Roundtable, the Financial Services Forum and the National Restaurant Association. It spent $5 million in 2001/2 making the case that Social Security would face a funding crisis in the future. Later it claimed its members were backing the president on this plan because they were concerned that he would otherwise use payroll taxes to make up the predicted social security shortfall. Bush denied that this would happen. Nevertheless, Compass was prepared to spend millions to help the campaign for private accounts. According to PR Watch:

COMPASS launched its "Generations Together" outreach effort in February. The group expects to spend $20 million on influencing public and Congressional opinion on Social Security privatization. The "grassroots" campaign will try to recruit more than 100,000 volunteers to voice their support for the President's Social Security plan at town hall meetings and rallies as well as make phone calls and write letters to members of Congress, demanding action on Social Security.

Various conservative groups added their own resources to the campaign. Progress for America budgeted $9 million and intended to raise more. Club for Growth hoped to raise $15 million for the campaign.

Various conservative groups added their own resources to the campaign. Progress for America budgeted $9 million and intended to raise more. Club for Growth hoped to raise $15 million for the campaign.

Similarly the group Third Millennium, whose board is peopled with young Wall Street professionals but which claims to represent Generation X, has campaigned for the privatisation of social security and the right of taxpayers to invest their social security funds in shares.

The privatisation of social security and the financial support it garnered in the business community, cannot be understood in terms of direct vested interests. Only the financial services companies, such as stock brokers and investment firms, stood to gain directly from the plan. The push is better understood in terms of a hidden political agenda. Bush presented the reforms as part of his vision of an ‘ownership society’: ‘When people have a stake in something’, his Treasury Secretary explained, ‘it makes the whole social system work better’. Also if social security is privatised and everyone has their own accounts, then they are no longer dependent on government for their retirement and this is supposed to change people’s relationship with government so that they take more personal responsibility for their future.